property tax calculator frisco tx

Effective property tax rates average 169 meaning Texan households pay an average of 3390 in property taxes each year. To use the calculator just enter your propertys current market value such as a current appraisal or a recent purchase price.

Taxes Don T Have To Be Scary I Can Sell Your House And Save You Money At The Same Time Send Me A Message To G Selling House Tax Deductions Selling Your

Enter your Over 65 freeze year.

. Our Application is as Easy as 1 2 3 Funded. Calculate an estimate of your property taxes. Avoid Increasing Late Fees and Save Money.

Counties in Texas collect an average of 181 of a propertys assesed fair market value as property tax per year. Enter your Over 65 freeze year. The Collin County tax bill now includes Collin County City of Frisco Frisco ISD and Collin County Community College district taxes.

Enter the value of your property. Mary and Jim Horn Government Center. A Frisco Property Records Search locates real estate documents related to property in Frisco Texas.

469-362-5800 Hours Monday through Friday 8 am. Please select your school. That being said Texas does fund many of their infrastructure projects etc.

Enter your Over 65 freeze amount. It is the duty of the Tax Assessor-Collector to assess and collect for the County all taxes imposed on property within the county. Property Taxes 225.

This home was built in 2020 and last sold on 142021 for 400000. This calculator factors in PMI Private Mortgage Insurance for loans where less than 20 is put as a down payment. 4 beds 25 baths 2664 sq.

Pin By Business Directory On Minnesota Nature Garland Tx Beauty Services Financial Services. Property Taxes in Frisco TX. Those property owners living in Denton County will still receive 2 statements.

2600sqft 4 bdrm 4th currently used as study 25. Enter your Over 65 freeze amount. Property Tax Rate NOTICE - Adoption of FY21 Tax Rate PDF Notice of 2020 Tax Rates PDF City of Frisco Tax Rates For Fiscal Year 2021.

Texas has one of the highest average property tax rates in the country with only thirteen states levying higher property taxes. Enter the value of your property. Cities counties and hospital districts may levy a sales tax specifically to reduce property taxes.

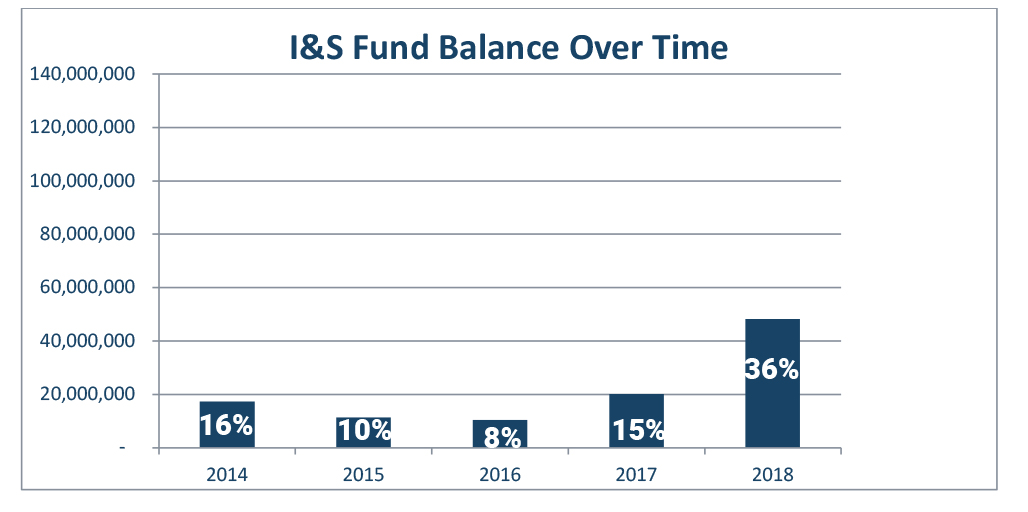

Property Taxes 246. For example the Plano Independent School District levies a 132 property tax rate and the Frisco Independent School District levies a 131 property tax rate. Property Tax Calculator Frisco Rmends Raising Property Taxes Texas Scorecard Frisco Property Taxes PISD adopts same tax rate for fifth year in a row Plano Star Courier starlocalmedia School Board Drops Tax Rate for Third Straight Year Frisco property tax rate to remain unchanged for 2020 What Is The Property Tax Rate Frisco Heres a new.

Truth-in-taxation requires most taxing units to calculate two rates after receiving a certified appraisal roll from the chief appraiser the no-new-revenue tax rate and the voter-approval tax rate. Please select your county. Learn about Frisco Texas property taxes from Frisco Top Realtor and Frisco Luxury Home Realtor Real Estate Agent - What is my Frisco home worth.

Property Tax Statements are mailed out in October and are due upon receipt. 1 from Denton County which will include Lewisville ISD and 1 from Collin County which will bill for the City of Frisco taxes due. To avoid penalties pay your taxes by January 31 2022.

Public Property Records provide information on land homes and commercial properties in Frisco including titles property deeds mortgages property tax. How to Get Your Taxes Reduced for Free. Please choose your exemption.

Property taxes in Texas are among the highest in the country. Texas taxes on a pack of 20 cigarettes totals 141 which ranks in the middle of the pack on a nationwide basis. Property tax calculator frisco tx Monday February 28 2022 Edit.

At this point property owners usually order service of one of the best property tax attorneys in Frisco TX. Property Taxes 221. Pay property taxes on time.

One of the fantastic things about living in Texas is the absence of a state income tax. Based on 2013 tax rates the following rates may be subject to change. Our Texas Property Tax Calculator can estimate your property taxes based on similar properties and show you how your property tax burden compares to the average property tax on similar properties in Texas and across the entire United States.

This is quite appealing to those relocating from many other states around the nation. This mortgage calculator can be used to figure out monthly payments of a home mortgage loan based on the homes sale price the term of the loan desired buyers down payment percentage and the loans interest rate. Homeowners in these areas should remember to claim the homestead exemption.

Homes in Frisco Denton County Frisco ISD. This type of an agreement means the cost you pay is restricted to a percentage of any tax. 10181 Soledad Rd Frisco TX 75035 725000 MLS 14764752 Looking for the unicorn.

Enter your Over 65 freeze year. 6101 Frisco Square Boulevard 2nd Floor Frisco TX 75034 Phone. Homes in Frisco Collin County Prosper ISD.

Enter your Over 65 freeze amount. Monday through Friday except holidays 8 am to 430 pm New Resident Services and Title transfers will only be processed between the hours of 8 am and 4 pm Monday through Friday. Ad We Pay Your Taxes NOW.

Homes in Frisco Collin County Frisco ISD. For more information call 469. The median property tax in Texas is 227500 per year for a home worth the median value of 12580000.

1 The type of taxing unit determines which truth-in-taxation steps apply. Youll pay only when theres a tax decrease when you join with protest firms on a contingent fee basis. 50 rows Property Tax Rate Comparisons around North Texas.

Please select your city. Create an Account - Increase your productivity customize your experience and engage in information you care about.

Five Tips For A Successful Relocation New Home Communities New Homes Dallas Real Estate

What Is The Property Tax Rate In Frisco Texas Dallas Real Estate Real Estate Property Tax

Get Your List Of All Homes With Pools Prosper Frisco Surrounding Areas And Get Detailed Information About Every A Pool Houses New Home Construction Home Buying

Buying Or Selling Irving Tx Real Estate The Timing Couldn T Be Bette Dallas Real Estate Real Estate Real Estate Marketing

Understanding Mortgage Closing Costs Lendingtree

Texas Income Tax Calculator Smartasset

Fort Bend County Ranks Very Low Among Places Receiving The Most Value For Their Property Taxes

Where Are Lowest Property Taxes In North Texas

Texas Income Tax Calculator Smartasset

Oakland County For Sale By Owner Three Things To Know Real Estate Humor Real Estate Fun Realtor Humor

How To Read Your Property Tax Bill O Connor Property Tax Reduction Experts Property Tax Tax Tax Reduction

Fort Bend County Ranks Very Low Among Places Receiving The Most Value For Their Property Taxes

What Is The Rule Of 72 Debt Relief Programs Collateral Loans Consolidate Credit Card Debt

/arc-anglerfish-arc2-prod-dmn.s3.amazonaws.com/public/QI625TTUVQOEPK4GKEGH556NRU.png)

Will The Truth About Texas Robin Hood Plan Lead To Its Demise

Home Taxes What Is Homestead Real Estate Articles Selling House

Homes Located In Top Notch Rated School Zones At The Home Solutions Realty Group We Know How Important It Is To Have Home Buying Fox Home Houston Real Estate

Recently Trevor And Mandy Bought A 500k Home And Got Back 7500 From Me Their Buyers Agent Whether You Are A Buyer Or A Text Me Just Giving Listing Agent